Latest analysis by cybersecurity firm ESET offers particulars a few new assault marketing campaign focusing on Android smartphone customers.

The cyberattack, primarily based on each a posh social engineering scheme and the usage of a brand new Android malware, is able to stealing customers’ close to discipline communication information to withdraw money from NFC-enabled ATMs.

Fixed technical enhancements from the risk actor

As famous by ESET, the risk actor initially exploited progressive internet app know-how, which allows the set up of an app from any web site exterior of the Play Retailer. This know-how can be utilized with supported browsers akin to Chromium-based browsers on desktops or Firefox, Chrome, Edge, Opera, Safari, Orion, and Samsung Web Browser.

PWAs, accessed immediately by way of browsers, are versatile and don’t usually undergo from compatibility issues. PWAs, as soon as put in on programs, may be acknowledged by their icon, which shows a further small browser icon.

Cybercriminals use PWAs to guide unsuspecting customers to full-screen phishing web sites to gather their credentials or bank card info.

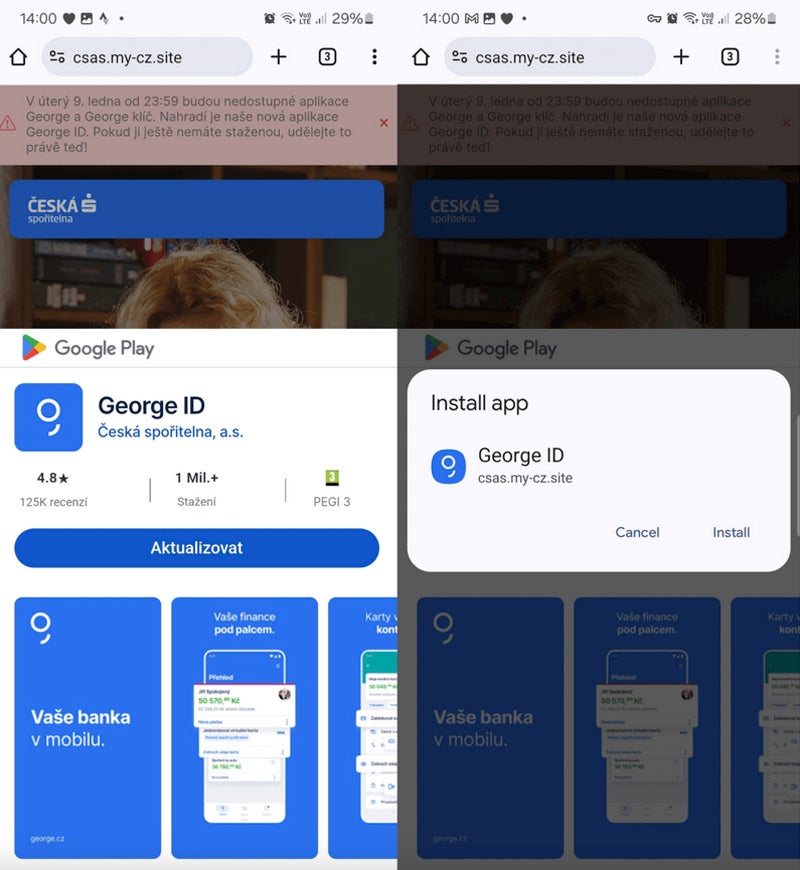

The risk actor concerned on this marketing campaign switched from PWAs to WebAPKs, a extra superior kind of PWA. The distinction is refined: PWAs are apps constructed utilizing internet applied sciences, whereas WebAPKs use a know-how to combine PWAs as native Android purposes.

From the attacker perspective, utilizing WebAPKs is stealthier as a result of their icons now not show a small browser icon.

The sufferer downloads and installs a standalone app from a phishing web site. That particular person doesn’t request any further permission to put in the app from a third-party web site.

These fraudulent web sites typically mimic elements of the Google Play Retailer to carry confusion and make the consumer consider the set up truly comes from the Play Retailer whereas it truly comes immediately from the fraudulent web site.

NGate malware

On March 6, the identical distribution domains used for the noticed PWAs and WebAPKs phishing campaigns all of the sudden began spreading a brand new malware known as NGate. As soon as put in and executed on the sufferer’s telephone, it opens a faux web site asking for the consumer’s banking info, which is shipped to the risk actor.

But the malware additionally embedded a device known as NFCGate, a professional device permitting the relaying of NFC information between two units with out the necessity for the gadget to be rooted.

As soon as the consumer has supplied banking info, that particular person receives a request to activate the NFC function from their smartphone and to put their bank card towards the again of their smartphone till the app efficiently acknowledges the cardboard.

Full social engineering

Whereas activating NFC for an app and having a cost card acknowledged could initially appear suspicious, the social engineering strategies deployed by risk actors clarify the situation.

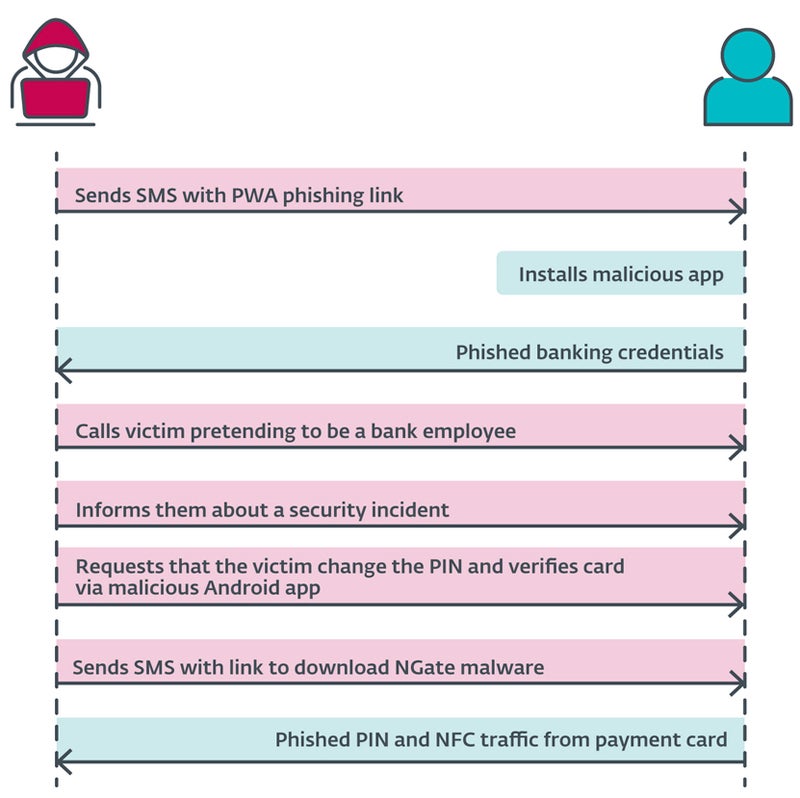

The cybercriminal sends a SMS message to the consumer, mentioning a tax return and together with a hyperlink to a phishing web site that impersonates banking corporations and results in a malicious PWA. As soon as put in and executed, the app requests banking credentials from the consumer.

At this level, the risk actor calls the consumer, impersonating the banking firm. The sufferer is knowledgeable that their account has been compromised, seemingly as a result of earlier SMS. The consumer is then prompted to alter their PIN and confirm banking card particulars utilizing a cellular software to guard their banking account.

The consumer then receives a brand new SMS with a hyperlink to the NGate malware software.

As soon as put in, the app requests the activation of the NFC function and the popularity of the bank card by urgent it towards the again of the smartphone. The info is shipped to the attacker in actual time.

Monetizing the stolen info

The knowledge stolen by the attacker permits for traditional fraud: withdrawing funds from the banking account or utilizing bank card info to purchase items on-line.

Nonetheless, the NFC information stolen by the cyberattacker permits them to emulate the unique bank card and withdraw cash from ATMs that use NFC, representing a beforehand unreported assault vector.

Assault scope

The analysis from ESET revealed assaults within the Czech Republic, as solely banking corporations in that nation have been focused.

A 22-year previous suspect has been arrested in Prague. He was holding about €6,000 ($6,500 USD). In line with the Czech Police, that cash was the results of theft from the final three victims, suggesting that the risk actor stole way more throughout this assault marketing campaign.

Nonetheless, as written by ESET researchers, “the potential of its enlargement into different areas or international locations can’t be dominated out.”

Extra cybercriminals will seemingly use related strategies within the close to future to steal cash by way of NFC, particularly as NFC turns into more and more widespread for builders.

Easy methods to defend from this risk

To keep away from falling sufferer to this cyber marketing campaign, customers ought to:

- Confirm the supply of the purposes they obtain and punctiliously look at URLs to make sure their legitimacy.

- Keep away from downloading software program exterior of official sources, such because the Google Play Retailer.

- Avoid sharing their cost card PIN code. No banking firm will ever ask for this info.

- Use digital variations of the standard bodily playing cards, as these digital playing cards are saved securely on the gadget and may be protected by further safety measures akin to biometric authentication.

- Set up safety software program on cellular units to detect malware and undesirable purposes on the telephone.

Customers must also deactivate NFC on smartphones when not used, which protects them from further information theft. Attackers can learn card information via unattended purses, wallets, and backpacks in public locations. They’ll use the info for small contactless funds. Protecting circumstances will also be used to create an environment friendly barrier to undesirable scans.

If any doubt ought to come up in case of a banking firm worker calling, grasp up and name the same old banking firm contact, ideally by way of one other telephone.

Disclosure: I work for Development Micro, however the views expressed on this article are mine.